General Motors Stock: Loans To Compensate Current Cash Drop

[ad_1]

President Biden Visits GM ZERO Manufacturing unit In Detroit, The place Battery Electrics Are Becoming Assembled Nic Antaya

As Mary Barra, General Motors Co. (NYSE:GM) chair, expressed with beautiful understatement in the course of the next-quarter earnings get in touch with with analysts on July 26: “This is a really one of a kind and dynamic sector that provides both equally challenges and possibilities for GM.”

GM has crafted approximately 90,000 automobiles – likely truly worth upwards of $4 billion – that cannot nevertheless be shipped to sellers because a single or a lot more parts (usually, semiconductor chips) are lacking. GM dealers, in the meantime, have only a ten-to-twenty day source of motor vehicles, most likely a 3rd of what they need to fulfill customer need.

Tight retail inventory

In these kinds of an ecosystem, GM and the sellers are in a position to offer autos at whole mark-up, thereby generating potent profitability. But the total cash generated is down sharply – and that dollars is wanted to pay out mounting costs for battery electric powered vehicle (BEV)-linked investments this sort of as the new Ultium Cells LLC plant in Lordstown, Ohio that will offer GM’s Detroit assembly plant that builds the new GMC Hummer EV. Between 2020 and 2025, GM is concentrating on $35 billion in cash, engineering and enhancement prices for new technologies like BEVs, autonomous automobiles and hydrogen gas cells.

Mary Barra, CEO (GM)

The prospect for sturdy BEV gross sales appears to be like optimistic, by just one measure, with extra than 80,000 “reservations” for Hummer pickup and SUV models 150,000 reservations for Silverado EV in 2023 and other BEV styles such as Cadillac Lyriq, Chevrolet Blazer EV and Chevrolet Equinox EV because of by means of 2023. BrightDrop Zevo commercial van production is because of to start later this year at GM Canada and Cruise is piloting industrial payment for robotaxis in San Francisco.

In the meantime, GM is including credit card debt to bolster its funds, evidently to protect a fall in income induced by quick-expression shortages of saleable automobiles to ship to sellers. A $2.5 billion Section of Electrical power bank loan to the GM joint undertaking constructing the Ohio plant – as effectively as long term vegetation in Tennessee and Michigan – will appear from the department’s Highly developed Technological know-how Vehicles Manufacturing application, which provides loans to guidance U.S. production of gentle-obligation vehicles, elements and other components that boost fuel economic system.

Funds from DC

Phrases of the authorities financial loan haven’t however been disclosed GM formerly announced that the Ohio plant represented a $2 billion investment, which was to have been financed internally. With battery technological know-how strongest at the second in China, South Korea and Japan, Vitality Secretary Jennifer Granholm, a previous Michigan governor, said: “As electrical autos and trucks proceed to grow in acceptance in the United States and close to the earth, we have to seize the chance to make advanced batteries — the coronary heart of this increasing sector — appropriate right here at house.”

On Jul 28 GM mentioned it was saying the pricing of two series of senior unsecured mounted level notes totaling $2.25 billion. The so-referred to as “Green Bonds” include things like $1 billion of 5.40% notes owing in 2029 and $1.25 billion of 5.60% notes thanks in 2032. They are created to assist fulfill GM’s environmental, social and governance (ESG) targets, like carbon neutral operations by 2040.

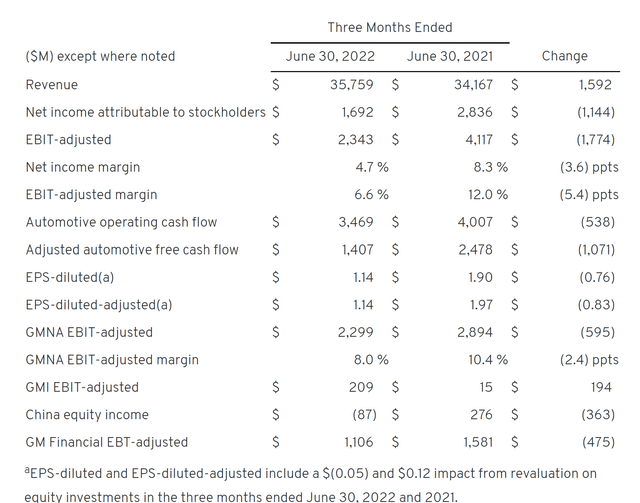

The $4.75 billion of new debt comes on the heels of a next quarter money report. GM’s internet profits in the second quarter fell to $1.6 billion ($2.3 billion on an EBIT-adjusted basis) from $2.8 billion ($4.1 billion on an EBIT-modified basis) a year earlier.

GM’s money expenses rose to $2.1 billion in the quarter from $1.5 billion a yr before. With internet automotive money from running pursuits falling to $3.5 billion for the quarter from $4 billion a calendar year back, altered automotive totally free funds move fell to $1.4 billion from $2.5 billion. In other phrases, on a quarterly foundation GM’s capex rose 40% YOY while altered no cost money flow fell 44% — environment the stage for securing further financial debt.

GM Q2 2022 Revenue Statement (GM)

Presented the backdrop of climbing desire prices, GM’s initiative to protected debt ahead of it will become additional highly-priced could prove prudent. As Barra mentioned for the duration of the earnings phone:

“While demand stays powerful, there are escalating concerns about the economic system to be positive. That is why we are previously having proactive techniques to deal with expenses and funds flows, including reducing some discretionary paying and limiting selecting to crucial demands and positions that aid expansion.”

Limited credit score ahead

Barra is working out prudence. While the supply of semiconductors and other areas might enhance in the 2nd half, the economic system has proven indicators of economic downturn and could weaken further more as the Federal Reserve tightens credit rating in get to stanch inflation. Political uncertain

ty is increasing as very well, with federal dollars for EV purchaser incentives and charging infrastructure wanting significantly less generous next the sinking of the Democrats’ Create Back Improved shelling out package.

The lesson from the runup to GM bankruptcy’s in 2009 is that abnormal debt can sink any firm, even (or especially) a behemoth with a legendary title and name. If Barra and her contemporaries figured out something, they certainly uncovered out that retaining a stable balance sheet and credit ranking are key survival strategies for any small business – and they’ve endeavored to permit buyers know they acquired the information.

GM’s strategy is predicated on sufficient income flow from internal combustion motor (ICE) vehicles – principally the Silverado pickup – assist the huge expenditure in BEVs, autonomous tech and gas cells. As the changeover requires spot more than the future decade or so, GM jobs that revenue and dollars move from electrified merchandise like Silverado EV, Blazer EV and Cadillac Lyriq will replace that made by today’s products.

The danger to buyers in GM popular is that imprudent borrowing habits from the earlier will return, loading down GM with financial debt, compromising its credit history score and leaving it susceptible to unforeseen catastrophes these as the World-wide Monetary Crisis. The timetable for widespread acceptance of BEVs remains murky – it’s nonetheless not apparent how soon common customers will be trading in their ICE motor vehicles for plug-ins.

GM shares keep on to sell far more or less for the identical $33 a share they did at their first general public featuring in 2010. With hard cash tight, GM can sick pay for to spend a dividend. (Cross-city rival Ford Motor Co. (F) has restored its dividend and lifted it to its pre-COVID charge.)

GM, in this writer’s belief, stays a Keep. Proprietors of GM shares really don’t encounter substantially downside risk at the recent cost in the minimal 30s. The exception would be if the automaker ways up borrowing – and personal debt rises precipitously – without having an adjustment in the company’s investment paying out on BEVs and other advanced technological know-how.

GM bonds hardly qualify as investment quality. Credit rating rating organizations will be observing GM closely, so traders should spend focus to the raters for any proof of stability sheet weakening.

[ad_2]

Resource connection